What is the purpose of a financial institution?

The prevailing answer is: To make money.

But when “making money” becomes the driving force of an organization, mediocrity is the result… at best.

It sounds harsh, but it’s also true.

Here’s why: When the leadership conversation focuses exclusively on targets and quotas, with little or no mention of customer impact, the team gets the message: customers exist for us. Instead of showing up to serve customers, the team views customers as a transaction.

The research is clear: organizations with a purpose bigger than money – those whose Noble Purpose is to improve the lives of their customers –financially outperform organizations who focus on internal targets and quotas.

Here’s why: An organization focused on internal targets and scorecards cannot create the competitive differentiation or emotional engagement required to win clients. They experience more customer churn and lower win rates than firms with a customer-driven purpose. An organization whose purpose is to improve the lives of their clients has a more compelling message for the market, their leaders spark innovation, and their people are more likely to go the extra mile. As a result they win more business.

The difference between a transactional organization and a Noble Purpose client-driven organization is a difference in ethos and approach that has a dramatic impact on employees, customers, and ultimately financial performance.

A recent dinner with friends provided some insights into client perception. As we were nearing the end of a leisurely meal, a friend asked the group, five professionals in their 40s and 50s, “Does anyone have a good dentist they recommend?” Everyone at the table jumped in. Two offered to make an email connection on the spot. There was even a tinge of competitiveness. I have a great dentist. Mine does follow up on calls. Mine gives you a warm neck roll.

The conversation got me thinking, how does this play out in other professions? So I asked about real estate agents, hairdressers, and doctors. Each time, my friends were excited to share their trusted experts.

Yet when I asked about banks and financial planners, the table fell silent. The mood noticeably shifted. One person said, “I have a guy, but I’m not sure you’d like him. He’s kind of salesy.” Another friend said, “I have a bank, but just for transactions. I do my own investing.” One woman said, “I tried a few people but never liked any of them.”

Of my four friends, only one recommended a financial advisor. Not one of them recommended their bank. These are relatively high net worth people, ideal prospects for financial services. Yet there was no enthusiasm for their advisors. My anecdotal dinner experience mirrors market data.

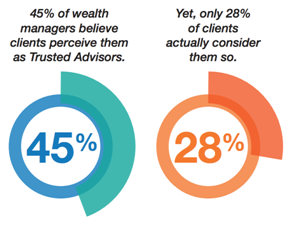

A recent study revealed, a mere 1 out of 3 customers are strongly committed to continuing to do business with their financial institution.Furthermore, 45% of wealth managers believe clients perceive them as Trusted Advisors, yet only 28% of clients actually consider them so.

Lack of trust and loyalty are symptoms of the much larger problem. The root issue is that banks have lost their sense of purpose. When customers are no longer the driving force, they know it. Declining trust and loyalty are the natural consequences of a banking system increasingly focused on internal targets and scorecards.

It’s true in wealth management, it’s true in corporate banking, and it’s true in retail banking.

This begs the question, why? And, what can be done to reverse this dangerous trend?

For starters, we must address the elephant in the room. It’s no secret that bankers have made some mistakes, serious mistakes. When these mistakes become public, it doesn’t matter who did it, it harms the entire profession.

With increasing pressure for sales, bankers are pushed into short-term thinking. Internal financial metrics take precedent over customer experience. The result is, innovation is stymied, customer-focused employees get frustrated or leave and it’s only a matter of time before an institution is commoditized and their reputation declines.

It’s not a pretty picture. Yet it’s happening every single day. In 2018, trust in financial institutions declined in 13 of 28 markets, including the United States.

It doesn’t have to be this way. There are pockets of success we can learn from. Our firm has helped a number of banks strengthen their relationship with customers and rise above a transactional approach. Instead of focusing exclusively on internal metrics, their organizational North Star is the client. Putting client-impact at the center of their commercial model creates a more competitive, differentiated organization.

I confess I have deep personal affinity for banking. My father was a banker, the old school kind, who knew his clients personally and cared about them deeply. He imbedded into me the belief that helping people with their money is one of the most important things you can do. He told me, “Money can create happiness or heartache.” He believed when you help people manage their money better; they manage their lives better.

It’s time for bankers to reclaim nobility of their profession.

When bankers decide their true and Noble Purpose is to help their clients achieve prosperity and peace of mind, they behave differently. It changes the questions they ask, the depth of solutions they propose, and even the way they carry themselves and talk about their jobs.

Behavior follows mindset. When bankers believe their primary purpose is to drive revenue, client interactions become transactional. Today’s clients are highly attuned to behavior that smacks of manipulation or dismissiveness. Said another way, when a banker is thinking I have to hit my number, clients can read their intent.

The solution starts with leadership. In our work with leadership teams, we often find a disconnect between an organization’s stated aspirations and their actual daily cadence.

In their work with thousands of bankers, David Greene of Greene Consulting has observed, “There is a Purpose void in the Retail Banking industry. Most Bankers feel their Purpose is simply to sell something. And, it’s a direct result of how they are being led. Managers rarely talk about the impact Bankers can and should have on the lives of their customers. Instead, the constant refrain is “sell more.” Failing to instill and cultivate a higher Purpose results in the loss of customer trust, sub-optimal sales results, and high levels of Banker turnover the industry is experiencing.”

How Noble Purpose Drives Revenue

The key question bankers (collectively and individually) need to ask is this: Do we have a Noble Purpose? Or do we just sell stuff?

The answer is directly linked to profitability.

Organizations with a Noble Purpose is to improve the lives of their customers, out- perform organizations focused on internal targets and quotas.

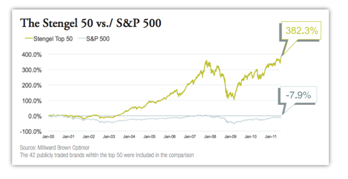

In his widely acclaimed book Grow, Jim Stengel documents how 50 of the highest-performing companies in the world harness the power of brand ideals to tower over their competitors. At the core of a brand ideal, is purpose. Stengel says, “Top performing brands are built on ideals, higher-order purposes that transcend products and services.”

Stengel, a former Procter &Gamble colleague of mine who oversaw huge growth during his tenure as P&G CMO, reveals that these purpose-driven organizations outperform the market by over 382%.

In many organizations, ‘purpose’ is not much more than window dressing; it’s a marketing slogan or community give-back.

Top-tier performance requires making Noble Purpose the center of the commercial model and activating it on every level. With a Noble Purpose as the North Star, teams improve competitive differentiation, emotional engagement, and ultimately drive greater earnings.

Top-tier performance requires making Noble Purpose the center of the commercial model and activating it on every level. With a Noble Purpose as the North Star, teams improve competitive differentiation, emotional engagement, and ultimately drive greater earnings.

An overemphasis on quantitative metrics points the organization inward, employees focus on short-term gains, there is little innovation, silos build, and mediocrity eventually prevails. No matter how much customer service training you provide, or how great your marketing is, the internal narrative drives external behavior.

Meaningful differentiation requires an outward focus on the people who actually drive your business: customers.

The Market Opportunity

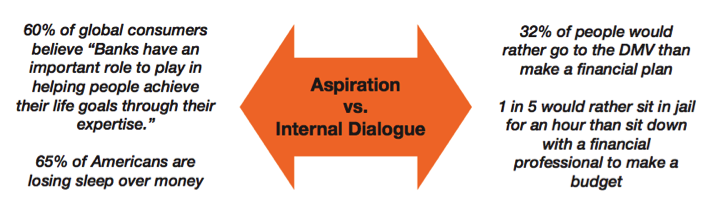

A full 60% of global consumers believe,“Banks have an important role to play in helping people achieve their life goals through their expertise.”

Yet, consumers resist accessing bank expertise:

- 65% of Americans are losing sleep over money

- 32% of people would rather go to the DMV than make a financial plan

- 1 in 5 would rather sit in jail for an hour than sit down with a financial professional to make a budget

For many, living in crisis is less painful than dealing with financial institutions.

Reframing Profit

Internal teams and boards who must deliver earnings can be leery of moving towards a purpose-driven business model. They fear that taking their eye off financial performance will erode earnings. Let’s be clear, becoming a Noble Purpose firm does not mean less financial rigor. It’s like a Broadway show, when you focus on connecting with the audience, you don’t let up your rigor on the technical performance. When you do both, you drive a better box office.

Customers are the Noble Purpose; financial results are the measurement of how well you are delivering on your aspirations.

In Thou Shall Prosper. Rabbi Daniel Lapin recalls a conversation with noted economics professor Walter Williams. Williams explains the relationship between purpose and profit saying, “Take out a dollar bill and look at it. Now pat yourself on the back because you are looking at a certificate of performance. If you did not rob or steal from anyone to obtain that dollar, if you neither defrauded anyone nor persuaded your government to seize it from a fellow citizen and give it to you, then you could have only obtained that dollar in one other way – you must have pleased someone else.”

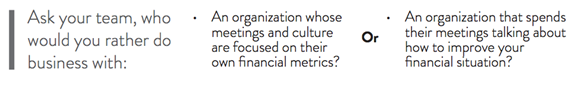

If your team is struggling to make the leap, ask them to think about their purpose from the client’s perspective: Who would you rather do business with? The organization whose meetings and culture are focused on their own financial metrics? Or the organization that spends its meetings talking about how to improve your financial situation?

The answer is obvious. The 28% of clients who trust their Advisors do so because they have confidence the advisor is putting their best interest first.

Redefining the Narrative

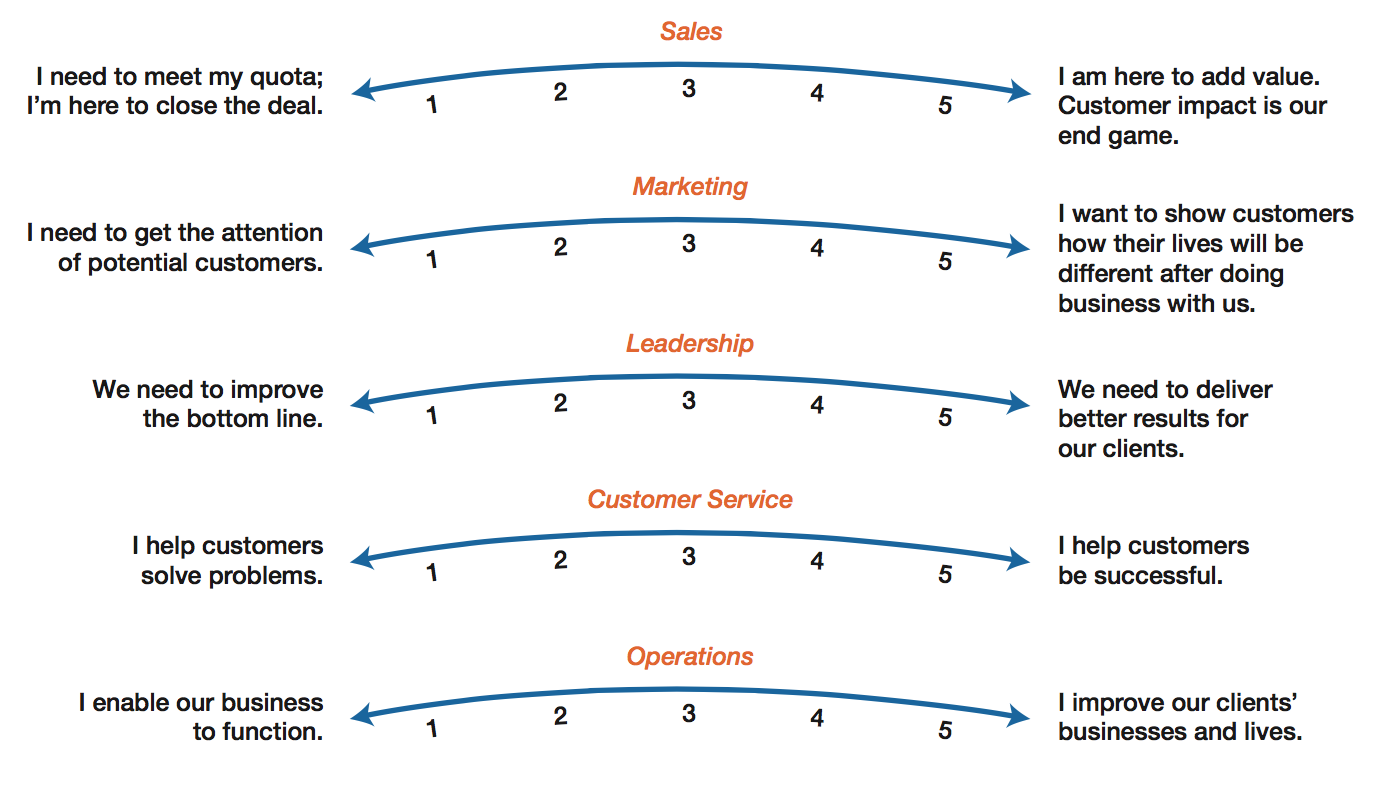

As you think about your core functions, how would your teams define their roles?

If you’re more to the left of the scale, you’re not alone.

In our work with hundreds of clients, I have yet to encounter an organization that says, “We do not care about the customer.” The challenge is one of focus. Ask yourself this simple question, how many times a week are your leaders reinforcing a higher purpose with their Bankers versus how many times are they focused solely on sales results?

When leaders continually reinforce the purpose of positively impacting the lives of customers, they connect the dots between caring for customers and financial performance. Shifting the leadership narrative is the first step to becoming a high performing team.

Elevating the Scorecard

Scorecards emerged from the very real need to assess results across a variety of areas. But scorecards are a financial snapshot, they don’t reveal much about client interaction or perceptions. The two major challenges with traditional scorecards are:

1. Scorecards are backwards looking:

A scorecard centered on metrics like loan and deposit growth, mortgages and referrals is measuring yesterday’s story. Those numbers are the result of behaviors that occurred in the past. If you want to write tomorrow’s story you have to measure today’s behavior.A Noble Purpose provides a frame for decision-making and measuring client impact. Among executives whose teams have a well-integrated purpose, 73% say it helps them steer through marketplace turmoil.

2. Scorecards measure “WHAT” not “HOW”:

Dan Greene, says, “Everyone measures what they’re doing, not how they’re doing it. What products are getting traction? What branches are falling short? That conversation is rarely taken to “how?” and “why?” because the scorecard is only focused on the what.”

Measuring financial performance is like measuring a runner on her time, and not looking at her strength, conditioning or practice routine. If the coach only yells, “faster faster faster!” her time will quickly plateau. Her time is the result of a myriad of things, you must coach and develop the habits and behaviors to produce the result.

High performing organizations infuse Noble Purpose into their scorecards to measure what matters most: clients. We’ve helped several banks add employee behavior and customer-impact into their Scorecards.

A Case Study in Purpose-Driven Banking

CEO Perspective

Manage to the Numbers, Lead to the Noble Purpose

Doug Williams, the founder and CEO of Atlantic Capital Bank says, “As bankers, our lingua franca is numbers, it’s our shared language. You tend to think of setting objectives as financial, and you’re comfortable talking about it in a financial way. But no one on your team is going to wake up thinking ‘We have to get a return on equity of 15%, I’m going to go do that today.’ The team needs a bigger purpose. They want to be part of something more than just hitting the numbers.”

During a recent bank-wide town hall I interviewed Williams on stage to help launch their Noble Purpose. He told his team, “We manage to the numbers, but we lead to the Noble Purpose.”

In our backstage work with the Atlantic Capital (ACB) Executive Leadership Team, we identified their points of competitive differentiation, and where they were doing well. It was clear; on their best day their secret sauce was their people and their commitment to clients.

Working with the ELT, with data from the field, we crafted their Noble Purpose: “We Fuel Prosperity.” From there, we honed the strategy. We spelled out clear target markets and aligned short- and long-term goals. Williams says, “Our business strategy should support our purpose.”

We then helped the leadership team cascade the purpose through every level of the organization. We connected the dots to each job, employees were asked to articulate how their individual role contributes to fueling prosperity, and managers were trained on coaching to customer impact.

During the celebration town hall Williams told stories about how ACB fuels prosperity for burgeoning businesses, major developers, fintech firms and others. The employees got the message: Our North Star is clients. What we do here matters.

Williams says, “As a CEO of a public company, you have time horizons and a quarterly review of reporting. You’re concerned with meeting or missing analysts’ expectations. Your board is concerned about the finances and corporate governance. But one of the board’s functions, and the CEO’s job, is to make sure the company is effective in fulfilling their purpose.

If you lead to the numbers, it’s hard for people to rally. What does an administrative assistant, IT manager, or marketing lead wake up every day and say? I want to improve the return on equity? At best it will be a vague notion. The same is true on the frontline. When bankers focus on fueling their client’s prosperity, it is a meaningful purpose, as opposed to creating loan growth of X or deposit growth of Y.”

Connecting to the true purpose of the institution, vs. short-term financial targets, is imperative for everyone, including the CEO. It creates a culture driven towards customers, rather than one that looks internally.

Williams emphasizes, “There are so many things that go into the financial equation we don’t control. Pricing and interest rates are a function of the market. We don’t actually have control of loan demand, that’s macro-economic factors. We can influence by working hard and selling hard and coming up with the right solutions.

What we do control is the experience of our customers. The correlation between leading to purpose and the company becoming more effective in that purpose produces financial results over time.”

A year after launching the Noble Purpose initiative ACB’s year-over-year operations before tax income increased by 81%. Williams and his team say there’s a new energy in the air. Clarity about their purpose enabled the executive team to make a smart divesture, without belaboring the process. Backstage teams are more customer-oriented, and bankers are pursuing new clients. Williams says, “Our Noble Purpose is an articulation of who we are at our best.”

A Noble Purpose puts a customer-focused lens on daily decision-making and operations. As our colleague, Roy Spence, says “Purpose doesn’t always make decisions easy, it makes them clear.”

Leadership Airtime

Running an organization is not that different from running a family. The leader sets the tone and tells the team what’s important. I observed just how powerful a leader’s words are through an experience with my daughter’s kindergarten class.

Several years ago, I was the class volunteer when the kids were making Mother’s Day presents. They were making booklets about their mothers. The teacher prompted them with “What are your mommy’s favorite things to do?” The kids then drew pictures and wrote words about what their moms love the most.

It was my job to staple the pages into a little book. Naturally, I read them.

Two themes emerged. According to a group of a 5- and 6-year-olds, their mothers’ favorite things to do were cleaning and sleeping. Clearly this merited further investigation. Who were these strange women?

I started asking the kids, “How do you know your mother’s favorite things to do are cleaning and sleeping?”

The answers were all the same.

“She talks about it all the time. She’s always saying: ‘We have got to clean up around here; we have got to clean up. And if she’s not talking about cleaning she’s saying, I am so tired, I have got to get more sleep.’”

The words of the leader matter. Whatever you give the most airtime to will be perceived as the most important priorities. Cleaning and sleeping got the most airtime, so to the kids they were the favorites.

Now it gets uncomfortable. Think about your own airtime, what would your team assume are your most important priorities?

Leaders who spend the majority of their airtime talking about the impact on clients create teams that outperform teams whose leader’s primary conversation is about quotas. Dan Greene says, “Show me your Scorecard and I will tell you exactly what the frontline thinks is important.” Dan Greene

When Noble Purpose sits at the top, when it’s measured and given the most airtime, it cascades down to every customer interaction.

A Slogan is Not Enough

I routinely get cold calls from bankers and financial advisors who want to “get to know me” and “become my trusted advisor.” This type of language does not garner immediate trust. In fact, just the opposite. People who say, trust me, are usually less than trustworthy. True trust develops from repeated behavior.

Financial institutions are doing an increasingly good job marketing themselves as helpful and client-oriented.

Campaigns about helping people plan, getting to know someone’s goals, etc. are a good start. But if the commercial depicting the nice woman, in a casual yet refined office, with a genuine interest in client’s goals doesn’t match the real client life experience, you’re better off spending your money on staff training than marketing.

Integrating Purpose into Front Line Behavior

One reason banks struggle to get retail personnel to engage with high-end clients in a meaningful way is what we refer to as the lifestyle gap. It’s the gap between the socioeconomic status of many branch bankers and their clients. This occurs in many industries. It results in overly product-focused conversations with little real engagement.

For example, we recently did a revenue growth project for a major mid-priced fashion retailer. During a mystery shopping store visit, I held a $100 blouse. The salesperson, nice as she could be, said, “It’s a bit of a splurge but it really makes a statement.” Instead of helping me find something to go with it, she was trying to sell me what she deemed to be an expensive item.

Over and over again, my team and I encountered store salespeople trying to sell high-end clients (the target demo) single items. As a member of the target market, I would have happily spent ten times the price of a blouse if it meant I didn’t have to shop for a year.

Retail salespeople aren’t typically comfortable starting a bigger conversation unless they’ve been trained. Swap clothing for financial services, the difference between retail bankers and their potential clients gets even bigger.

Retail bankers are tasked with relating to people who live completely different lives, have different priorities, and different ideas of what constitutes a “big investment.”

Without a framework for this conversation, the majority of internal dialogue is about “products.” Not about impact. This doesn’t prepare bankers for meaningful conversation.

When product is all you know, and product is what you’re measured on, product becomes the driving topic in client interactions. It’s easier to talk to someone about cash back rewards on a credit card than to ask them how credit card debt impacts their life.

In many years of consulting, I have yet to meet a client who walks into a bank saying, “Tell me about your products.” Clients don’t talk that way. Products are what you buy at the grocery store. People go to a bank to organize their money, get advice, buy a house, and navigate retirement.

When bankers learn to understand a variety of customer lifestyles and financial situations, and when they’re infused with an urgent sense of purpose, the conversation changes.

A purpose-driven banker is not afraid to ask strategic questions. They’re genuinely inquisitive because they know their purpose is to help someone. They’re urgent about need, because they see the impact a positive financial future has on clients. They’re politely persistent because their aim is to deliver value for the person in front of them.

As Dan Greene puts it, “We’re seeing an increasing focus on financial wellness as opposed to traditional banking. According to a recent study by the American Psychological Institute, over 65% of U.S. households stated they feel moderate to significant stress about their finances. The question is why? Their stress is most often less about where they are today and more about what they can do to gain greater control. Bankers need to be equipped with a simple framework for helping customers take control over their financial lives.”

An Emblematic Experience

My business partner, Elizabeth Lotardo, a millennial, describes her own experience with retail banking.

In terms of a prospect, I was a layup.

I have a checking account with one of the big banks. Like a lot of millennials, I chose my particular bank because they were the bank on campus when I was in college. My consistent $150 checking balance didn’t attract much attention.

When I graduated college, my relationship with my bank didn’t change. I never reached out to them, and they certainly never reached out to me.

Despite regular direct deposits of a halfway decent salary, nothing changed. Despite aggressively paying off federal student loans, nothing changed. Despite changing jobs, and an increasing direct deposit, nothing changed.

When I turned 25, and decided to start seriously saving and potentially investing, I wasn’t emotionally attached to big bank. Nonetheless, I decided to give em’ a whirl, because honestly, who wants to fill out more paperwork and remember another password?

(I told you. Layup.)

So, I make an appointment, and into the bank I walked. I’ve finally crossed the account balance where the bank is willing to actually speak to you without an $8 fee, so this is new to me.

I enter an awkwardly sparse office. My “personal banker” smiles at me, and asks what I wanted to talk about. I reply, “saving and investing.”

She had contacted me 20 minutes beforehand to make sure I would show up. She has complete access to my financial records. She can find out how long I’ve been a customer, how much I make, my recurring expenses, etc.

Yet, there I sat, across from her, spelling my last name for the third time.

She takes out a pamphlet with a few account options, then, proceeds to pitch me on mortgages, credit cards, and some other products I didn’t fully understand.

I left, slightly more confused than when I went in, and feeling approximately 0% more attached to the bank.

Then, I see an ad for Ellevest, a virtual, women-focused investment service. I set up a personal phone call to talk about my financial goals. Low and behold, I move money from Big Bank right on over.

I never had a problem with Big Bank. I still use them for my checking account. The woman in the meeting was nice enough. The app works decently. But, my relationship with Big Bank is transactional. And transactional relationships are replaceable.

My experience isn’t unique, but it is emblematic.

LinkedIn notifies me asking if I’d like to learn more about so-and-so, when I have a meeting with them in 15 minutes.

Wayfair reached out when I changed my address, asking if I am furnishing a new place.

The guy who sold me my car personally called me when it was time for an oil change.

But none of that happened with the Big Bank. Not once.

Step Up or Step Out

The window of opportunity is wide open. With only 1 out of 3 customers strongly committed to continuing to do business with their financial institution, the chance to win business is high.

Banks who want to create competitive differentiation and move beyond transactional relationships must organize their narrative, process, measurements, and training around a client-driven purpose.

Need more of an incentive? By 2020 women will control two-thirds of all wealth. Yet 91% of women reported feeling that financial services companies were more interesting in selling them products than providing advice. Women are very skilled at reading intent. As financial guru Dave Ramsey says, “If your wife says, ‘I don’t like him,’ run for the door. She’s reading him and she’s probably right.”

Bankers who cannot make the leap from self-interest to client-interest will face a challenging future. Financial institutions that fail to elevate the client experience will quickly find themselves commoditized.

Bankers who put their clients first will stand out. It’s time to decide: Are banks going to reclaim their noble purpose? Or are you just trying to sell stuff?

The choice is yours.